Arthur Forrest II

Licensed Broker & Senior Field Underwriter

National Producer Number : 18768588

Started: April 2018 (6 years)

Licensed in 30+ States Nationwide

Art's Bio:

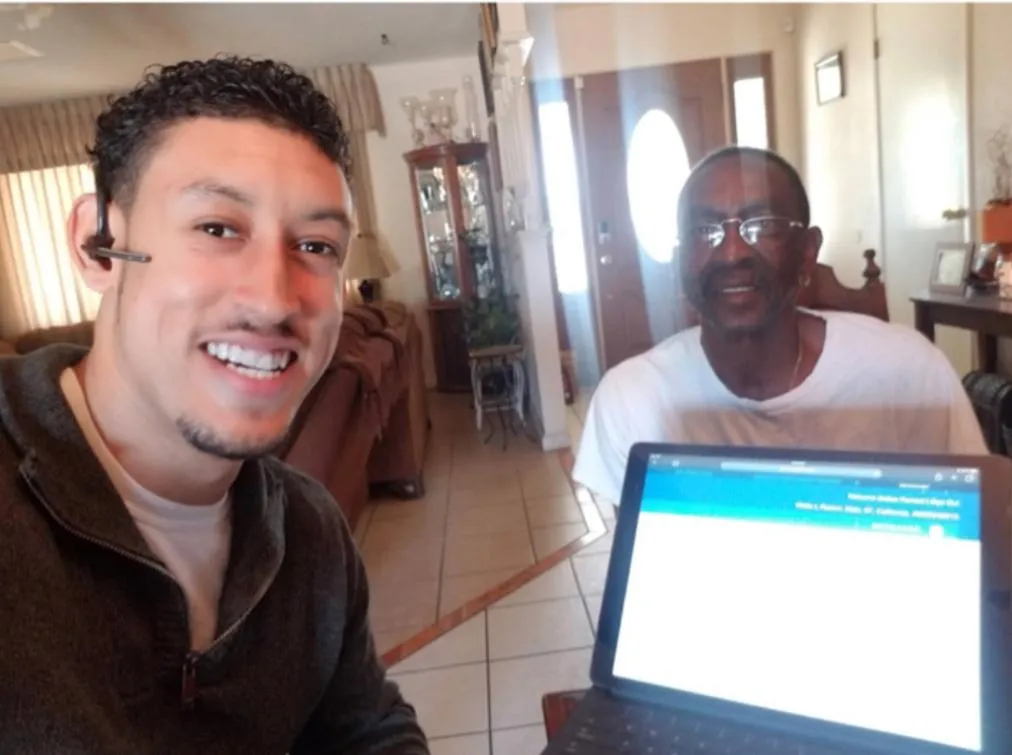

Hey! It’s nice to meet you; my name is Art. Before we begin our journey together, I want to Thank You for choosing me as your Life Insurance Broker. I’m looking forward to getting to know you, and growing a relationship to last a lifetime. Here's a quick glimpse of "who I am" .

I was born and raised in Chino Hills, California; middle child of three to Mrs. Toni and Dr. Arthur T. Forrest. My father has owned a private dental practice for 40+ years 😁. My earliest memories start in an office environment. With my dad having that Vietnam Vet, “get-it-done by any means” mentality, I had a fairly strict upbringing. He demanded excellence, not only in school… but in all walks of life.

Eventually, those life lessons rubbed off on me. Taking care of business has always been a priority. I ended my grade school years as a 3-sport athlete, eventually receiving a full-ride Division 1 scholarship to the University of Nevada, Reno to play football. While attending college, I made the Academic Dean’s List multiple semesters and ultimately obtained my Bachelor’s Degree in Business Management in 2014. View fullsize After graduation, I married my best friend Chanel Forrest and obtained my Realtor License (which I keep active to date). Being a Realtor was very rewarding, but it stole my time freedom. I worked 7 days a week and missed out on precious family time. In the summer of 2019, my family home of 27 years set ablaze and burnt down in a bushfire. 🔥🔥

My family and I literally lost everything we’ve ever owned. Due to losing our home, my father stressed his way to a heart attack and six strokes- all within one calendar year. I was forced to find another field of work so I can help rebuild our family home since we were so underinsured. Little did I know- Becoming an Insurance Broker was one of my best life decisions. I am still able to do what I love- which is assisting my aging family while helping new families start their own legacy. Since then, I have grown immensely- and take pride in constantly learning new techniques of the trade. Losing everything you own overnight, getting married, and having children forces you to look at life from a different perspective.

I know Insurance Products like the back of my hand now. I am currently licensed in over 30 states, with intention of being able to help everyone in America in due time. Furthermore, I have built genuine relationships with all walks of life. Having an “All-Star” team to handle every aspect of the Underwriting Process has also tremendously contributed to our growth. This field of work is most rewarding is when you go from a stranger to a family member with your clients. I am very passionate and love what I do. We consider every client to be a close friend/family member; and looking forward to considering your family, as well.

Types of Coverage Offered:

FINAL EXPENSE

Final Expense Burial Life Insurance is used to help people pay for funeral, burial, and cremation expenses when their day comes. A lot of seniors use final expense to make sure their families don't come out of pocket when they pass away.

MORTGAGE PROTECTION

Mortgage Protection Life Insurance is used to help the owners of the home pay off the house for their surviving spouse or children in the event of a death or disability. A lot of clients use this to protect their greatest asset: their home.

INCOME REPLACEMENT

Income Replacement Life Insurance is used to protect someone's salary for their family. If they pass away prematurely, their family will receive their income for the next 5 or 10 years to make sure the family's standard of living is the same.

RETIREMENT PROTECTION

Retirement Protection Life Insurance is using Fixed Indexed Annuities to protect clients 401K's, IRAs, and managed accounts, from downside risk. We can also use this insurance vehicle to generate an income for our clients for life.

TAX-FREE RETIREMENT CREATION

Tax-Free Retirement Creation uses Indexed Universal Life insurance policies to generate a retirement plan for those who are self employed or do not have a retirement plan in place. Using IULs, you can protect your cash value from downside risk while participating in gains.

INFINITE BANKING

Infinite Banking Life Insurance uses traditional Whole Life insurance policies with dividends to allow you to outperform a bank. The interest in dividends pay more than leaving money in any checking or savings accounts. A lot of clients use this to become financially free.

License Verification / Credentials

National Producer #: 18768588

What Clients Are Saying About Art:

Michelle B.

"I've met with 3 other agents and none of them were able to get me insured. Thankfully Arthur called, because I was able to get qualified immediately!

Bryan T.

The previous agent showed me something that was twice as expensive as what Arthur showed me. I was so turned off by the previous agent, but I decided to give it one more shot and I'm glad I did. We got covered the same day we spoke on the phone!

Ashley I.

"If it wasn't for Arthur, I wouldn't be able to sleep comfortably at night. I've been putting this off for so long. Arthur made the process of getting insurance so seamless and comfortable. I highly recommend Arthur to anyone!"

Christina B.

"Arthur was the nicest and most professional agent I've dealt with while shopping for insurance. I was initially nervous about buying insurance over the phone, but he made it so easy for me to get insurance to protect my kids."

Industry's Best Insurance Providers

Request Your

Life Insurance Quote

Fill out the form with your contact information and Arthur will get back to you as soon as possible.

“EXCELLENCE IS AN ‘ATTITUDE’ THAT SAYS ‘GOOD’ CAN BE DONE MUCH BETTER.”

© Copyright 2025. Agent Validation. All Rights Reserved.